We are nearly at the end of one of the most turbulent periods in the global financial markets since COVID-19 created havoc.

However, investors are not panicking, as the credit markets remain “relatively” calm, and the equity fear gauge (VIX) has not breached the danger levels.

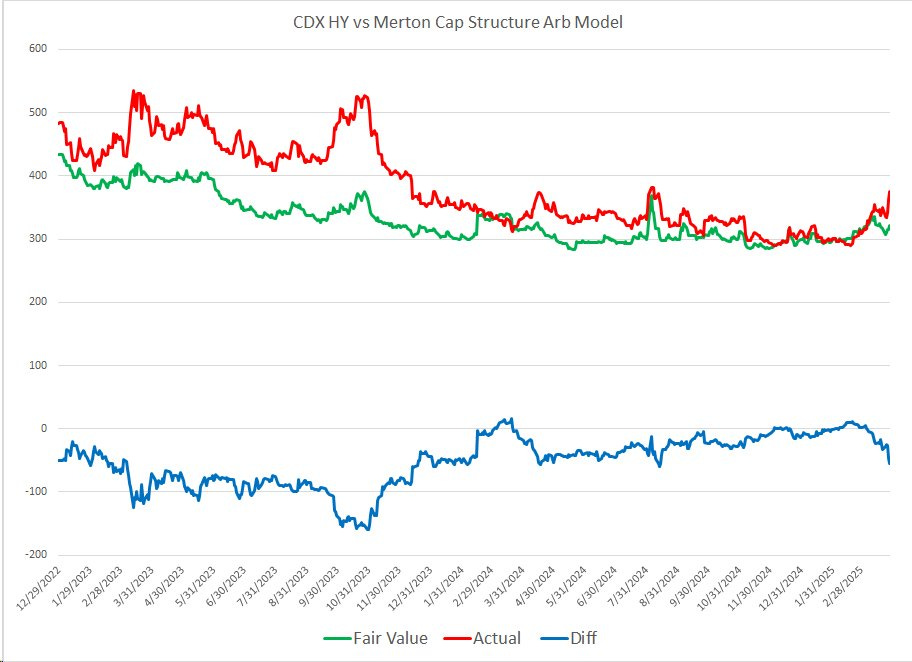

Note that High-Yield Credit Spreads (HY) are much lower than the 2022 equity bear market highs, implying that credit investors are optimistic about the growth prospects/ don’t see bankruptcies rising.

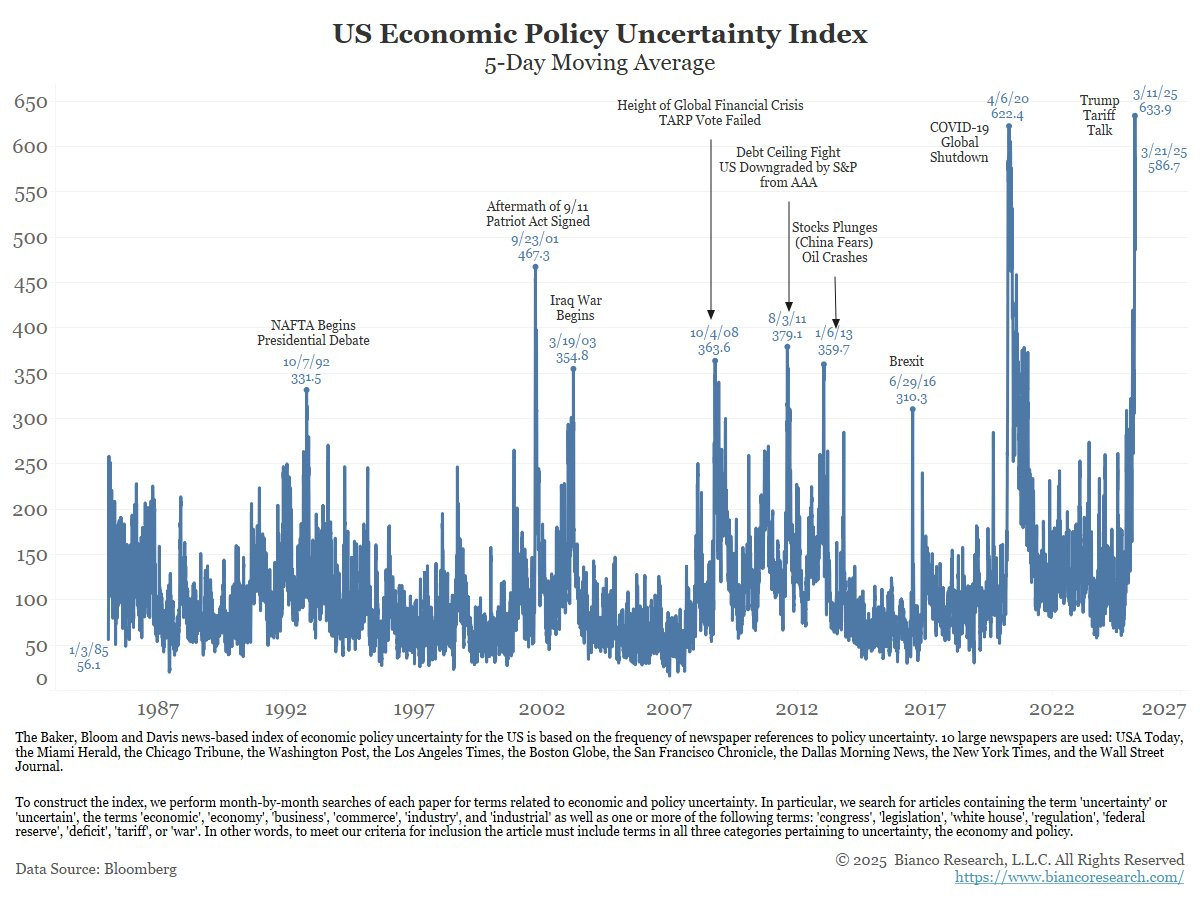

Nonetheless, uncertainty is off the roof, as we have indicated for several weeks. The Trump administration's policy flip-flops are making investors jittery, and they have been running to buy safe-haven assets (Gold).

We have now crossed the COVID highs in the US Economic Policy Uncertainty Index as Liberation Day (2nd April) nears and wild negotiations are underway.

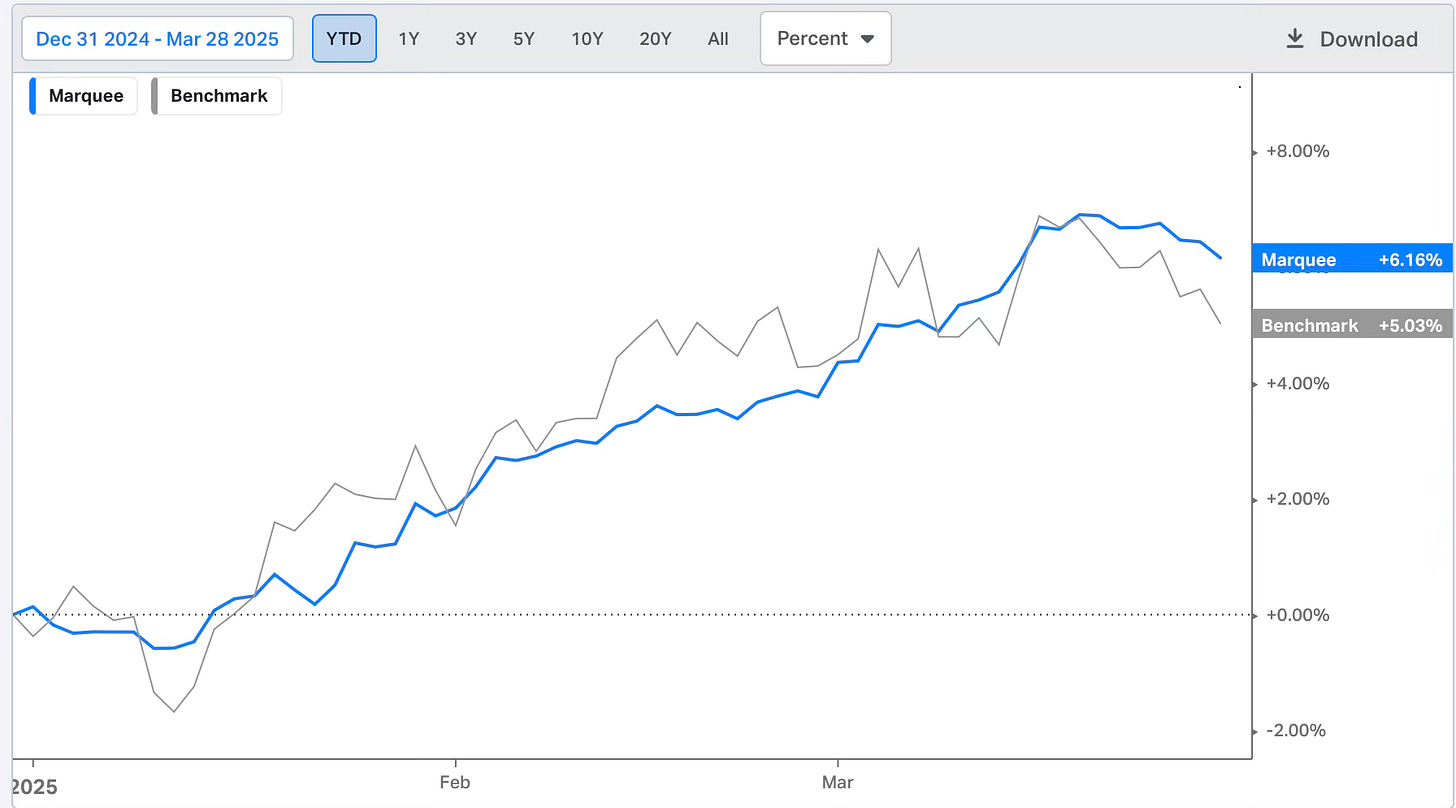

Amid all the chaos, we have significantly outperformed our benchmark thanks to our high cash allocation and short position on the S&P 500 (underweight equity stance).

PS: Benchmark is 60% MSCI ACWI Ex-US and 40% Bloomberg Global Aggregate.

If we include MSCI ACWI, then the outperformance is enormous (600 bps), but since we have minimal exposure to the US markets, we have undertaken the MSCI ACWI Ex-US.

Let’s comprehend the cross-asset performance.

Equities!

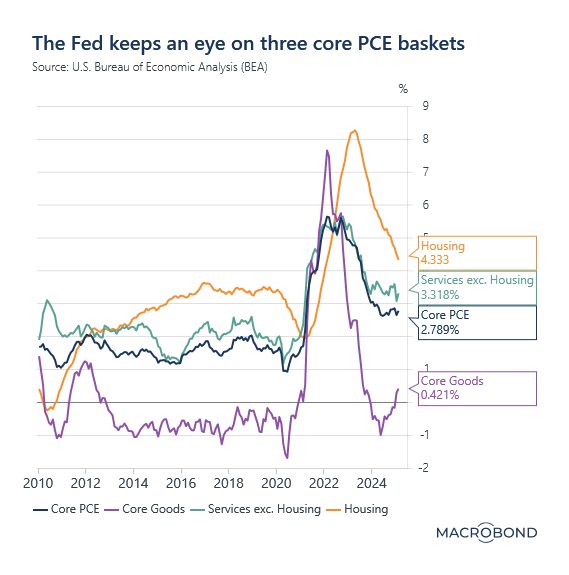

Before we begin the equities section, we want to analyse yesterday's PCE data. For those who are unaware, Core PCE is the US Fed's preferred inflation measure.

The Core Goods jumped higher as the base effect kicks in. Note that this was before the impact of tariffs on the prices of goods.

Furthermore, the Supercore PCE (Services Ex-housing) also rose rapidly, which was the sole reason the core PCE came in hotter than expected (2.8% vs 2.7%).

Thus, there is no reason to believe that inflation will cool down for at least next 6 months; and we expect the core PCE to be sticky around the current levels unless the economy rapidly slows and enters into a recession which lead to a demand slowdown and crash in prices.

Moving on, one shouldn’t be surprised that the best sectoral performance YTD came from

Keep reading with a 7-day free trial

Subscribe to Marquee Finance by Sagar to keep reading this post and get 7 days of free access to the full post archives.